These small acts can make a difference during collections time. Big and small companies alike can benefit from making small friendly gestures like a friendly call or e-mail to check in. Happy customers are happy to pay for the goods and services provided. 2) Build Strong Customer RelationshipsĪ good relationship with your customers will help you get paid. If you have a payment system for your sales, it is less daunting for your customers to pay smaller, regular bills than one large bill every quarter. Billing on time and often will also help your company collect its receivables quicker. The more accurate and detailed your invoices are, the easier it is for your customers to pay that bill. 1) Invoice Accurately, On Time, and Often Here are a few tips to help you improve your Accounts Receivable process to cut down collection calls and improve your cash flow. Collecting your receivables is definite way to improve your company’s cash flow. Making sales and excellent customer service is important but a business can’t run on a low cash flow. One of the top priorities of business owners should be to keep an eye on their accounts receivable turnover. 7 Tips to Improve Your Accounts Receivable Turnover Ratio So, the company’s accounts receivable turned over 10 times during the past year, which means that the average account receivable was collected in 36.5 days. = $3,500,000 Net credit sales ÷ $350,000 Average accounts receivable Based on this information, the accounts receivable turnover is calculated as: Net credit sales for the last 12 months were $3,500,000.

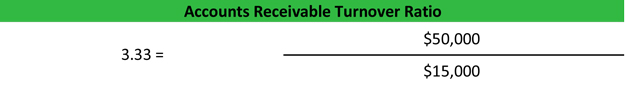

In the beginning of this period, the beginning accounts receivable balance was $316,000, and the ending balance was $384,000. Net Annual Credit Sales ÷ ((Beginning Accounts Receivable + Ending Accounts Receivable) / 2)įor example, a company wants to determine the company’s accounts receivable turnover for the past year. The formula to calculate Accounts Receivable Turnover is to add the beginning and ending accounts receivable to get the average accounts receivable for the period and then divide it into the net credit sales for the year. What Is the Accounts Receivable Turnover Formula? Tracking your receivables turnover can be useful to see if you have to increase funding for staffing your collection department and to review why turnover might be worsening. Low turnover is likely caused by lax credit policies, an inadequate collections process and/or a customer base with financial difficulties. A company should consider collecting on excessively old account receivable that are tying up capital, if their turnover ratio low. If the turnover is high it indicates a combination of a conservative credit policy and an aggressive collections process, as well a lot of high-quality customers. The longer is takes a business to collect on its credit, the more money it loses. Businesses that maintain accounts receivables are essentially extending interest-free loans to their customers, since accounts receivable is money owed without interest. The Accounts Receivable Turnover Ratio indicates how efficiently a company collects the credit it issued to a customer.

How Do You Find the Accounts Receivable Turnover? If you need income tax advice please contact an accountant in your area. NOTE: FreshBooks Support team members are not certified income tax or accounting professionals and cannot provide advice in these areas, outside of supporting questions about FreshBooks. What Is the Accounts Receivable Turnover Formula?ħ Tips to Improve Your Accounts Receivable Turnover Ratio

0 kommentar(er)

0 kommentar(er)